Look A Little Deeper Into That Sales Funnel

It seems to be the style — especially with digital businesses — to talk about a funnel that starts with views or clicks and ends with someone signing up for your service — as though acquiring a new customer is the end goal. Articles discuss “growth” in terms of numbers of new customers. Even some investors seem to be hooked on this top line focus for growth in all kinds of businesses.

My cell service provider must think so too. When I called to ask why new customers were getting a better deal than I was, even though I’d had my plan for 6 years, the rep calmly and matter-of-factly told me to “just switch to another provider for awhile” to get their new-customer good deal, then switch back as a newbie for my original company’s good deal. Really?

But saying — or even proving — you can get new customers doesn’t mean you have a good business.

To do that you have to be able to show a profit. That means:

1. Holding onto customers.

2. Managing expenses.

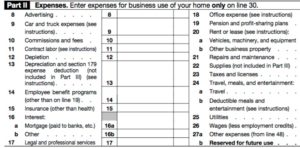

What expenses? Well, for example, just take a look at the Schedule C for the tax return you’ll file as a business: Wages and contract labor expenses, taxes, benefits, rent, travel, advertising, legal and accounting fees and more.

Being a successful business means generating enough cash flow to pay these expenses –all of them — and still have enough left over for profit.

(One recent post even posed the question about whether and when a founder should take a salary. The comments were sharply divided on the answer.)

Seriously, would you invest in a business that wasn’t supporting a reasonable salary for the founder?

Sure, customer acquisition is the lifeblood of every business. But it’s critical to take a break from rhapsodizing about how many people are going to sign up and have a serious, rolled-up-shirt-sleeve planning session, doing multiple what-if pro forma scenarios for profitability.