Pricing Part II: Let Customers Help You Arrive At The Right Price

In our last post, we described how your customers’ perception of the value they receive from your product is the starting point for setting your price.

There are plenty of examples of what not to do. Look at what’s happening with credit card companies and providers of TV/phone/internet services.They’re so obsessed with attracting new customers, they’ve completely abandoned any pretense of caring about the clients they’ve already got. They offer ridiculously good deals to people who switch from other providers and pay for it by overcharging existing, loyal customers whom they assume will be too lazy to switch.

But people are leaving. In droves. Switching their TV/phone/internet plans back and forth opportunistically between carriers to take advantage of temporary price breaks, or opting for internet only and dropping TV and phone entirely. And in the world of revolving credit, they’re repeatedly transferring large credit card balances among credit card companies to take advantage of temporary no or low-interest offers.

Sure, customer acquisition is important, but not at the expense of losing faith with people who have proven their loyalty to your company and its products. The providers of these services either don’t know or don’t care that they are subsidizing their own bleak futures by these reckless pricing moves.

You can do better. By focusing on what customers want and value and what they will pay for. From your online surveys and point-of-sale one question surveys, you’ll get an idea of what your customers value the most. This is critical so you can make sure your products have the features and capabilities that came up most in those surveys.

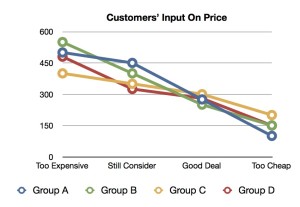

Then you have to ask them what they’d be willing to pay. Leave it open-ended the first time around. Let them come up with the number that meets each of these four criteria (courtesy of Patrick Campbell, CEO of Price Intelligently):

- Too expensive.

- Getting expensive, but I’d still consider buying it.

- This is a good deal!

- So cheap that I’d start to question the value and quality.

In our hypothetical case study, we asked 4 groups (Groups A, B, C and D) to select a price that would meet each of the above criteria. If you plot the results on a spreadsheet, you’ll see that the averages of responses form a range for each the criteria, and that they converged around 300 for the Good Deal price. You’d probably want to set your going in price just above that point, where the higher estimating groups started crossing the lower-estimating groups’ lines just higher than the $300 mark.

Then you have to repeat this a couple times a year to keep it fresh. Your customers will give you a clue by their buying decisions whether you’ve got it right, but you still have to go back and ask again.

Remember, the market isn’t standing still. Competitors are introducing and retiring products, and customers needs are changing. You’ll want to stay on top of all environmental changes in the market for your product.