It’s Not Too Late To Include A New Initiative This Year

It’s already well into January. Your 2018 plan and budget have been locked since before Thanksgiving. But there’s this new idea that looks like it could really generate some incremental revenue. How can you make room for it in this year’s work?

You have to start by getting clear on the distinction between spending money for business-as-usual work and money spent for shorter-term, special initiatives like this one.

Your regular budget — that thing you spent weeks getting finalized last fall — is mostly all about business-as-usual. You have a line in your budget for every expenditure: your offices, salaries or consulting fees for people who work with you, utilities, legal, accounting, web design and maintenance, subscriptions, conferences, travel, etc.

People love to talk about “burn rate,” the rate at which a company uses up its capital to finance overhead before generating positive cash flow from operations. In other words, it’s a measure of negative cash flow, and is built on two assumptions:

- Using money this way is deemed to be the equivalent of burning it, using it up or consuming it.

- The use is assumed to be for overhead, or the general expenses of running the business.

You’re right to be concerned about it, for sure. You’ve got venture capital, bank loans or “corporate budget money” and you have to spend money to get your business up and running. You don’t want to be in the red any longer than you have to be.

The concept of burn rate works when all money-making opportunities are known up-front and neatly wrapped up in the assumptions of your initial budgeting and financing process and VC and bank presentations.

But here you’re presented with a special opportunity that promises to bring in some incremental revenue. That’s going to require you to shell out some additional cash and dedicate some of your time and that of some of your people to make it happen. Where’s the line item in your budget for that? Right. There is none. Does that mean you shouldn’t do it?

Not necessarily. But to proceed, you have to do a special analysis. After all, just as the expense is exceptional, so is the opportunity for reward.

You’ve got to ask: Assuming I will incur these expenses for this initiative and I get this incremental revenue over this period of time, is it worth doing?

The expenditure of funds in this context are not really burned — or expended, but rather invested. (One way to view it is analogous to the distinction between fuel, which is used up in the process, and food, which serves to nourish and growth the organism that consumes it.)

We can refer to such a special opportunity as an initiative, and rather than either turn it down because there’s no money for it in the regular or business-as-usual budget or recklessly say “what the heck” and go for it, you ought to have a process for go/no go decisions that’s based on real numbers.

A simple expenses and revenue spreadsheet will work very well to give you what you need for most decisions.

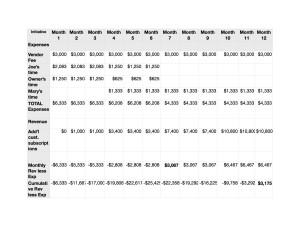

First look at what you’ll have to be spending each month only on this initiative:

Assume for the months 1,2 and 3, it’ll require 10% of your time and 25% of your associate, Joe.

Then in 4, 5 and 6 15% of Joe’s and 5% of yours and 20% of Mary’s.

Then in months 7 – 12, just the 20% of Mary’s.

Next estimate the revenue from this initiative.

Assume the following: Month 1 – 0. Months 2 and 3 = 25 new leads; 5 conversions at $200 each. Months 4, 5 and 6 = 60 new leads; 12 more conversions for a total of 17 customers at $200 each. Months 7,8 and 9 = 80 new leads; 20 more conversions for a total of 37 customers at $200 each. Months 10, 11 and 12 = 100 more leads; 17 more conversions for a total of 54 customers at $200 each.

Using a simple spreadsheet, you can plot the Revenue and Expense projections.

Note that the turnaround month — the month in which revenue for the month is expected to exceed that month’s expenses — is Month 7. And the break-even month — the month in which total revenue exceeds total expenses is Month 12.

Once you input the basic information, you can change it to model different scenarios or add other expense items as you become aware of them.

With a simple spreadsheet and a little bit of time to come up with some reasonable business assumptions, you can go from a blank sheet and an empty room to a meaningful go/no-go discussion on a promising project that has come up months after your plans and budget for the year have been locked.